Customer Services

Copyright © 2025 Desertcart Holdings Limited

Desert Online General Trading LLC

Dubai, United Arab Emirates

Full description not available

J**M

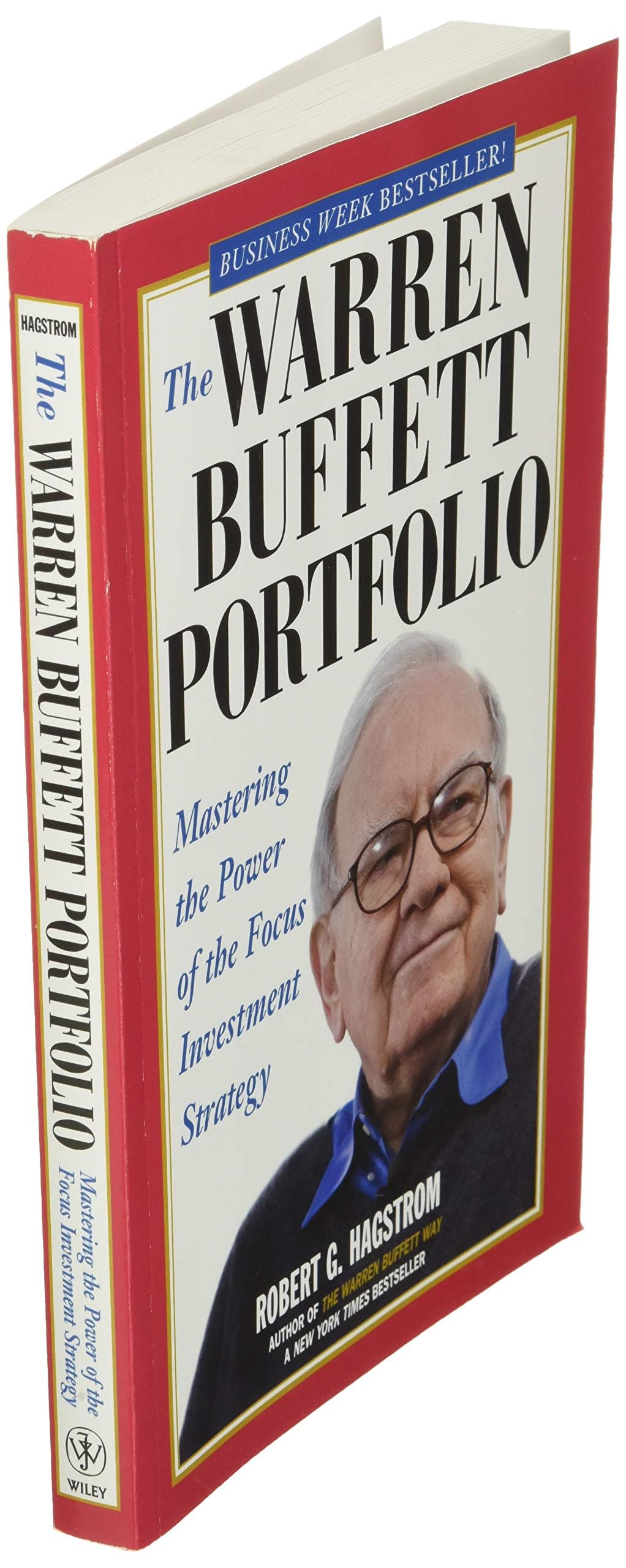

A rare thing - a good investing book

I would go as far as to call this book a masterpiece. It is one of the only books where it gets better toward the end, and is readable in only a few hours despite being packed with useful ideas. I would highly recommend.

F**K

He is the greatest investor. Why not read

Good gift for young person looking to make long term investments

J**T

Keep it Simple Stupid, we learn from Warren Buffett to step back

We all know the brilliance of Warren Buffett and his snippets of wisdom, but this book goes further to give us clear insight into the Buffet way of investing. Using the KISS theory, Keep it Simple Stupid, we learn from Warren Buffett to step back, slow down, research, and pick companies for the long run. More is not better and picking only ten superstar companies at opportune prices for the long term can be the answer. No day trader tips here, think “invest for the long term.” The one quote I like the best, paraphrasing, was if your stocks are like having an NBA team and one of your players (stocks) is Michael Jordan, why would you think of selling him off so you could say you were more diversified. If you are interested in investing in individual stocks and are interested to hear about an alternative theory besides buying 60 percent mutual fund total stock market and 40 percent mutual fund total bond market, you will find this book informative and fascinating.

M**D

Important read in Times of Covid 19

While a dated book , the sound investment advise of making a few good investment decisions during your life time is more important than reaching for the next invest idea of the moment. In these troubling times it is great to look at how the masters of investing have weathered previous storms. A lot of analysis on active management vs passive. Good input on how to avoid risk and maximize ones investment returns through Warrens look at company valuations and not the hype .

A**E

quick and worthwhile read

good info on the buffet mindset of investing and financial psychology.highly recommend. info is presented in organized manner and is palatable to average reader.

Y**

Good read

Good read.

D**W

Solid book on Buffet's approach to focused investing

I purchased this book after I realized it was one that Charlie Munger recommended during a Berkshire Hathaway shareholder meeting. The central theme is that investors should not be afraid to make larger bets on solid companies that they are confident will do well, rather than overly diversifying in many mediocre companies. The book is laid out well and is fast reading. My only reason for deducting one star is that it comes across somewhat dry, and I prefer The Essays of Warren Buffet (a book that is "authored" by L. Cunningham, but which mostly consists of Buffet's words directly). Still, I gained knowledge from reading this book and recommend it to others who would like to learn more about Warren Buffet and Charlie Munger's recipe for a wildly successful investing career.

S**T

One of the better books on Buffett's thought processes

I have read several books on Buffett, Munger, and other investors. This book, more than the others, presents the thought processes Buffett goes through when qualitatively assessing people and companies. This book will not give you tidy formulas with which you can match Buffett's portfolio performance. It will give you help on developing a mental framework to understand what it is the legendary investor is looking for, and perhaps help you look at companies (not stocks) in a similar way.

Trustpilot

1 month ago

2 weeks ago