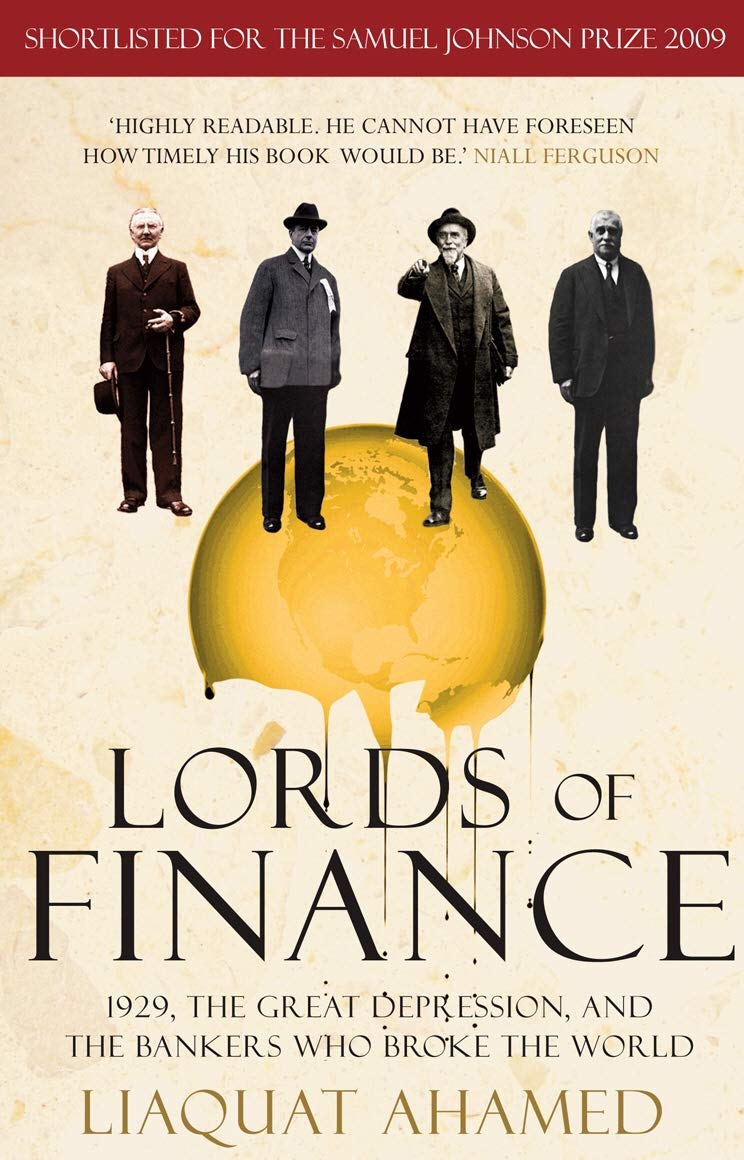

Random House Books for Young Readers Lords of Finance: 1929, The Great Depression, and the Bankers who Broke the World

L**S

Most interesting financial boom I’ve read so far

Great book...gives us a chance to understand all the path to the 29 crisis, passing through the First World War and shaping the way that the most important financial heads think back then.

J**K

Superb history, readable and informative

This did not turn out to be the book I thought I had ordered, but it proved a compelling read nonetheless. I thought I would get a book the explained the "springs and levers" that connected the Wall Street crash to bank failures to the depression. This was not made clear, and in hindsight it Is clear this book is aimed at a reader more knowledgeable in macroeconomic matters than I am.Nevertheless, it is a fascinating book, extremely well written ( if not extremely well proofed) and very approachable even if you don't understand clearly some of the cause/effect relationships it talks about. Essentially it is a history of central banking and the growth of the effects of the Gold Standard during the inter war years, told through the roles played by the 4 chief protagonists, the Governors of the central banks of U.K., Germany, France and the New York Fed. Maynard Keynes features prominently and is shown as a key player in the increasing awareness of the limitations of the gold standard. The story focuses on the struggles of these four Governors in trying to deal with the fallout of the post-war reparations imposed on Germany, and the near-bankruptcy of both the UK and French governments during the depression. The US suffered enormously from the post-crash depression, but I never realised just how much it profited from the Allies from its war loans, to the extent that I can't help suspecting that the US took deliberTe action to accelerate the demise of the British Empire to impose its own hegemony. The French national stereotypes are played out again, both in its negotiations of the Reparations and its refusal to countenance meaningful reductions in the face of evidence that Germany would be unable to pay (consider that in today's terms relative to the size of the German Economy, reparations amounted to $2.4 trillion dollars !). The French position on Brexit negotiations (no discussion on Trade without settlement of the "divorce bill") came to mind several times as I read this book.Anyone looking for a history of the growth of the role and expertise of Central Banks will find this a very useful read. Equally, it presents a very readable history of the main characters, especially the governor of the Central Banks and New York Fed, but also of the roles of FDR, Herbert Hoover and Winston Churchill, as well as John Maynard Keynes in this seminal period in Western economic history. A great read.

ダ**ル

Very good

Very well detailed. Nice reading.A recommended one.

N**F

Why the Governor on FED of N.Y. and not Chairman of FED Board

"Lords of Finance - The Bankers Who Broke the World" by Liaquat Ahamed is an intimate look at the lives of four central bankers and the friendships forged between them. The thesis of the book seems to be that the Great Depression of the 1930's was not caused by a series of converging events but instead was brought about by the decisions made by the "Lords of Finance". Who are these "Lords" you may ask?Germany's Hjalmar Schacht - Head of the ReichbankBenjamin Strong - Governor of the Federal Reserve Bank of New YorkMontagu Norman - Head of the Bank of EnglandEmile Moreau - Head of the Banque de FranceI have to give kudos to Mr. Ahamed for authoring such an entertaining and interesting look into a subject that some would consider to be dry monetary history or should I say biography seasoned with economic and monetary history. The later description being the secret to the book's entertaining quality. Mr. Ahamed delves into the personal lives of his Lords and focus not only on the economics and policy but also the friendships and animosities.Some people dismiss the book as Keynesian propaganda, since the book doesn't address the financial machinations and manipulation that was going on at the time behind the scenes. Although I sympathize with their criticism, I still believe that the "Lords of Finance - The Bankers who Broke the World" is relevant and insightful, for one should always read opposing views and keep an open mind. For those readers who would like to learn more about the so called "Conspiratorial" point of view, I will recommend some other works following the review.Note: I use the term "Conspiratorial" loosely without the intent of marginalizing that school of thought.I found it revealing that Mr. Ahamed's chose Benjamin Strong "Governor of the Federal Reserve Bank of New York" as the main American Protagonist not any or all of the four individuals who served as "Chairman of the Federal Reserve Board of Governors" during the period. The four individuals I refer to are Charles S. Hamlin, William P. G. Harding, Daniel R. Crissinger, and Roy A. Young. I believe Mr. Ahamed's choice of focusing on the private corporation that is Federal Reserve Bank of N.Y. instead of the governmental body called the Federal Reserve Board of Governors was the correct choice. It screams out, true power lies in New York not Washington.The main criticism I've already mentioned above and labeled the "Conspiratorial Point of View" which Mr. Ahamed doesn't address in any significant manner in the book. To give you an example of information ignored by Mr. Ahamed was Congressman Louis McFadden's speech on the floor of the House of Representatives charging the Federal Reserve Board of Governors, the Comptroller of the Currency, and the Secretary of the Treasury with Treason, Unlawful Conversion, Conspiracy, and Fraud. McFadden mentions the funding of Hitler and the Bolsheviks rise to power by the Federal Reserve Banks. The information is out there if you take the time to do the research.To summarize, The "Lords of Finance" is an interesting read the way the story ebbs and flows between the main characters makes for masterwork in writing. I wish most books were this well written. My only issue is with the thesis that a group of bankers mishandled the power of their offices and that lead to the Great Depression, but they didn't intend to cause a depression. I contend that Mr. Ahamed is correct except with respect to intention. To me the evidence shows that at least Montagu Norman and Benjamin Strong and probably Hjalmar Schacht knew that the plan was to cause a depression and they actively worked towards that end in secret.Now for the list of Books:Wall Street and the Rise of HitlerWall Street and the Bolshevik Revolution: The Remarkable True Story of the American Capitalists Who Financed the Russian CommunistsWall Street and FDRConjuring HitlerThe Creature from Jekyll Island: A Second Look at the Federal ReserveSuper Imperialism - New Edition: The Origin and Fundamentals of U.S. World DominancTrading with the Enemy: the Nazi-American Money Plot 1933-1949Tragedy & Hope: A History of the World in Our TimeThe Memoirs of Cordell Hull (2 Volume Set)The Great Contraction, 1929-1933: (New Edition) (Princeton Classic Editions)Money Creators

G**A

Está muy bien escrito y cuenta una historia muy interesante y crucial para comprender la historia del siglo XX

Es un libro excelente y ameno que nos cuenta los problemas de la política monetaria internacional desde el ángulo de los cuatro banqueros centrales que tuvieron más intervención en su diseño: los de USA, Inglaterra, Francia y Alemania. Como dije más arriba, es un libro muy útil para comprender los orígenes de la Gran Depresión, que fue el episodio económico más traumático del siglo XX y que marcó todo el desarrollo histórico del mundo a partir de entonces. ¿Por qué no pongo 5 estrellas? Quizá porque, en aras de la legibilidad, el cañamazo teórico es un poco endeble. No equivocado, sino ligero.

Trustpilot

1 month ago

1 day ago